Clarification regarding Rule 15 of the Railway Service Conduct Rules 1956- The following decisions were taken 1. Transactions, subject to the financial limits laid down in the rules, made out of the funds of the dependents of the Railway servant- Immovable property- In the case of class I and class II Officers, these should be reported along with the annual property returns but in separate form. In the case of class III and Class IV staff, these should be reported immediately after the Railway servant comes to know of them. Movable Property- These should be reported immediately after completion of the transactions or immediately II. Rules 15(1) (2) and (3) will apply in cases where a Rly. servant transfers the property to a member of his family. III. Transaction as member of Hindu undividedjoint family do not require Government's prior permission. These should be reported in the annual return of after completion of the transaction, as the case may be. (iv) The instructions may be implemented liberally

| Keywords | Central Civil Services Rules P.B. Jain |

| Department | Ministry of Railway |

| Branch | Establishment Discipline and Appeal |

| From Year / Date (YYYY-MM-DD) |

1959 |

| To Year / Date (YYYY-MM-DD) |

1959 |

| Identifier | PR_211200018844 |

| File No. | E/DandA/59GS1-8/1-9 |

| Location | Repository-4 |

| File Size | 29.3 MB |

| Pages | 30 |

| Collection | Digitized Public Records Ministry of Railway |

| Language | English |

-

5 views

Other Similar Items

-

- 358 Views

- Outstanding under U-Remittances- Accounts with Sta...

- Department: Ministry of Railway

- Branch: Accounts III

- Year / Date: 1968

-

- 281 Views

- 1) Change in the name of Railway Station Koliwada ...

- Department: Ministry of Railway

- Branch: Accounts III

- Year / Date: 1968

-

- 192 Views

- Change in the name of Village Mayuram as Mayiladut...

- Department: Ministry of Railway

- Branch: Accounts III

- Year / Date: 1968

-

- 4 Views

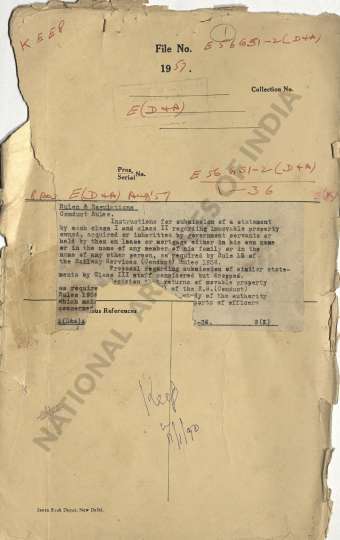

- Rules and Regulations - Conduct Rules - Instructio...

- Department: Ministry of Railway

- Branch: Establishment Discipline and Appeal

- Year / Date: 1957

-

- 5 Views

- Railway Services (Conduct) Rules 1956- General Ins...

- Department: Ministry of Railway

- Branch: Establishment Railway Board III-IV

- Year / Date: 1960

-

- 2 Views

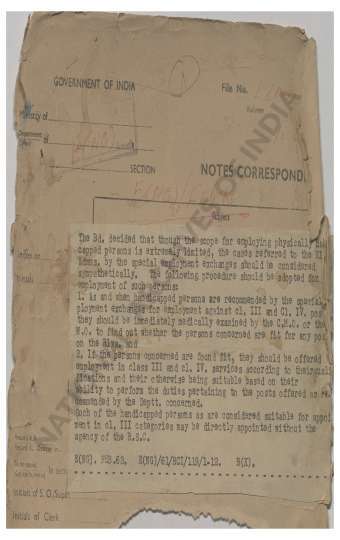

- The Bd. decided that through the scope for employm...

- Department: Ministry of Railway

- Branch: Establishment Non Gazetted

- Year / Date: 1961

-

- 4 Views

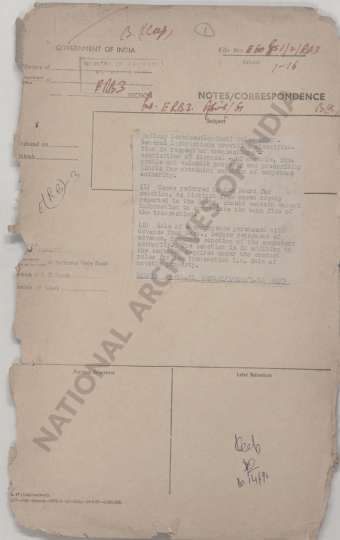

- Conduct: Rules and Regulations Rules- Instructions...

- Department: Ministry of Railway

- Branch: Establishment Discipline and Appeal

- Year / Date: 1957

-

- 4 Views

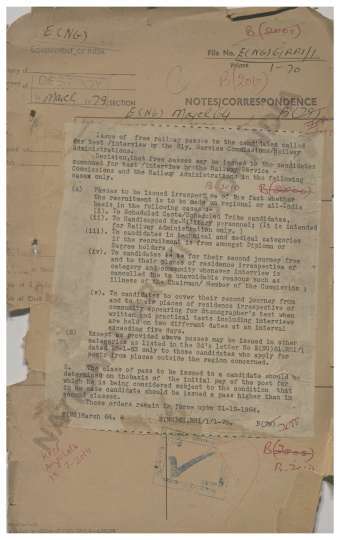

- Issue of free railway passes to the candidates cal...

- Department: Ministry of Railway

- Branch: Establishment Non Gazetted

- Year / Date: 1961

-

- 2 Views

- Review of the April 1964 standards for officers in...

- Department: Ministry of Railway

- Branch: Establishment Gazetted Recruitment I

- Year / Date: 1964

-

- 4 Views

- Railway Services (Conduct) Rules 1956-General Inst...

- Department: Ministry of Railway

- Branch: Establishment Railway Board III-IV

- Year / Date: 1960