Interpretation of section 19 of the Excess Profits duty Act 1919(X of 1919). Ruling that the sole proprietor of a business whose only source of income is his business is entitled to the concession granted by section 19 of the Act, but that if he has any income from ant other source, he is liable to pay super-tax on his full income in addition to the amount of excess profits duty paid by him on his business profits.

| Department | Finance Department |

| Branch | Separate Revenue |

| From Year / Date (YYYY-MM-DD) |

1920-05 |

| To Year / Date (YYYY-MM-DD) |

1920-05 |

| Identifier | PR_000001470827 |

| File No. | Progs., Nos. 82-83, May 1920. |

| Part | PART A |

-

14 views

The National Archives of India is on a mission to digitize and make available online each and every record in its repositories. This is an ongoing effort and some records will be made available before the others.

Hereby you can give us your request for a particular record and we shall digitize and make it available on priority, at a fee, subject to its availability in legitimate conditions.

Other Similar Items

-

- 537 Views

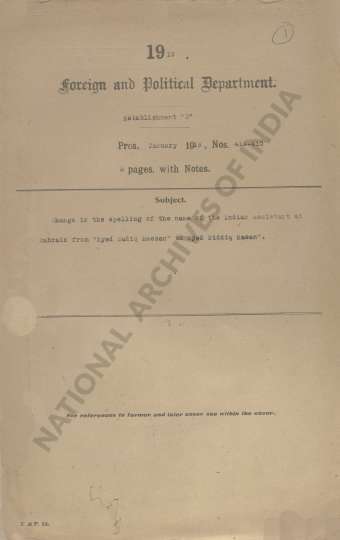

- Change in the spelling of the name of the Indian A...

- Department: Ministry of Home Affairs

- Branch: Public I

- Year / Date: 1966

-

- 5 Views

- Interpretation of section 19 of the Excess Profits...

- Department: Legislative

- Branch: Unofficial

- Year / Date: 1920

-

- 19 Views

- Local Governments informed that registered firms a...

- Department: Finance Department

- Branch: Separate Revenue

- Year / Date: 1920-10

-

- 10 Views

- Local Govt. informed that registered firms are not...

- Department: Legislative

- Branch: Unofficial

- Year / Date: 1920

-

- 32 Views

- Ruling of the Madras High Court that profits deriv...

- Department: Finance Department

- Branch: Separate Revenue

- Year / Date: 1920-04

-

- 18 Views

- Indian Income tax Act, 1922 - Sec.19-A - Return un...

- Department: Central Board Of Revenue

- Branch: Income Tax

- Year / Date: 1939

-

- 4 Views

- Publication of the draft rules under section 18 of...

- Department: Finance Department

- Branch: Separate Revenue

- Year / Date: 1919-06

-

- 2 Views

- Publication of the Draft rules under section 18 of...

- Department: Legislative

- Branch: Unofficial

- Year / Date: 1919

-

- 1 View

- Allowances in assessing business income – Income a...

- Department: Central Board of Revenue

- Branch: Income Tax,Part-IV

- Year / Date: 1941

-

- 15 Views

- Super-tax - Dividends - Non-resident Shareholder -...

- Department: Central Board Of Revenue

- Branch: Income Tax

- Year / Date: 1928