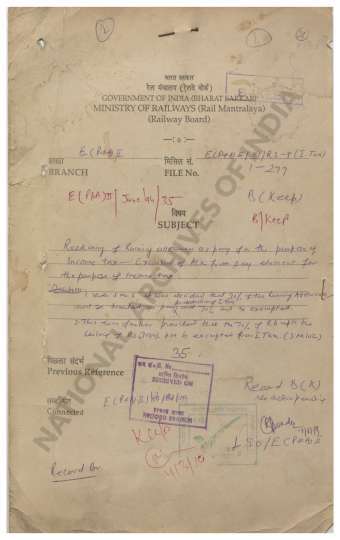

Reckoning of Running Allowance as pay for the purpose of Income Tax-Exclusion of ALK from pay element for the purpose of I/Tax. Decision- 1. Vide S.No. 6 it were decided that 30% of the Running Allowance with be treated as pay for deducting Income Tax and 70% will be exempted. 2. This were further provided that the 70% of RA upto the ceiling of Rs. 3000/- pm is exempted from I Tax.(S. No. 102)

| Keywords | Shri R.P. Yadav Income-Tax Act India Guards Council |

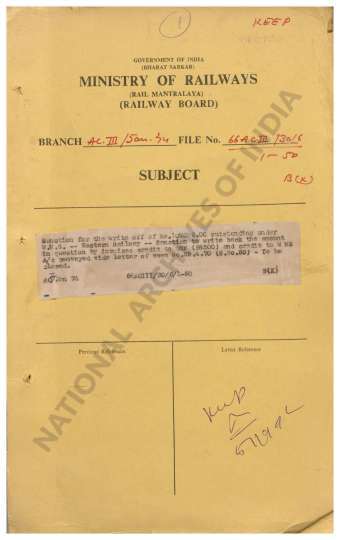

| Department | Ministry of Railway |

| Branch | Establishment Pay and Allowance II |

| From Year / Date (YYYY-MM-DD) |

1981 |

| To Year / Date (YYYY-MM-DD) |

1981 |

| Identifier | PR_211200048249 |

| File No. | E/P and A/II/81-RS-9/I-TAX/1-277 |

| Location | Repository-4 |

| File Size | 249.2 MB |

| Pages | 514 |

| Collection | Digitized Public Records Ministry of Railway |

| Language | English, Hindi |

-

10 views

Other Similar Items

-

- 2 Views

- Reckoning of Running Allowance as pay for the purp...

- Department: Ministry of Railway

- Branch: Establishment Pay and Allowance II

- Year / Date: 1981

-

- 247 Views

- Change in the name of Village Mayuram as Mayiladut...

- Department: Ministry of Railway

- Branch: Accounts III

- Year / Date: 1968

-

- 434 Views

- Outstanding under U-Remittances- Accounts with Sta...

- Department: Ministry of Railway

- Branch: Accounts III

- Year / Date: 1968

-

- 328 Views

- 1) Change in the name of Railway Station Koliwada ...

- Department: Ministry of Railway

- Branch: Accounts III

- Year / Date: 1968

-

- 1 View

- Action on the Pending Recommendations of Running A...

- Department: Ministry of Railway

- Branch: Establishment Pay and Allowance II

- Year / Date: 1981

-

- 1 View

- Action on the Pending Recommendations of Running A...

- Department: Ministry of Railway

- Branch: Establishment Pay and Allowance II

- Year / Date: 1981

-

- 2 Views

- Quarter Master General Bombay Exemption from Incom...

- Department: Finance Department

- Branch: Accounts

- Year / Date: 1861-04

-

- 2 Views

- Indian Income-tax Act, 1922- Proviso to Sec. 10(2)...

- Department: Central Board Of Revenue

- Branch: Income Tax

- Year / Date: 1940

-

- 62 Views

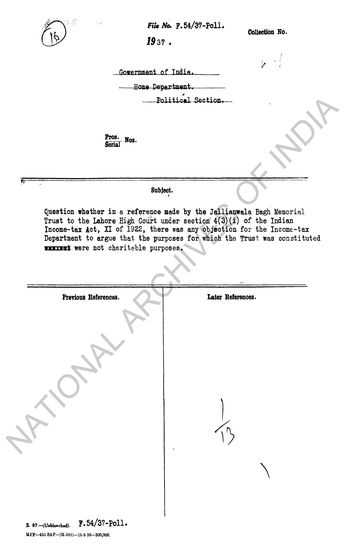

- Question Whether in a Reference Made by the Jallia...

- Department: Home Political

- Year / Date: 1937

-

- 530 Views

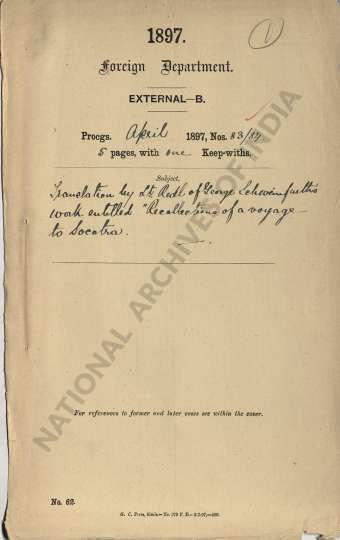

- Translation by Lt. Redl of George Sehwein furth's ...

- Department: Foreign

- Branch: External-B

- Year / Date: 0158-07-11